If you are running a gambling business, it is essential to comply with anti-money laundering regulations. This is to prevent any illegal activities on your platform while ensuring a safe environment for your customers. In this section, we will provide you with the necessary AML compliance tips to help your online casino operate in compliance with regulations.

As a gambling company, you must comply with specific anti-money laundering regulations. Failure to comply with these regulations may lead to heavy fines and even the loss of your license. Therefore, it is essential to stay up-to-date with compliance requirements.

Key Takeaways

- Compliance with anti-money laundering regulations is crucial for gambling firms.

- Failing to comply with AML regulations can lead to heavy fines or license revocation.

- Stay up-to-date with the latest compliance requirements.

Understanding Anti-Money Laundering (AML) Regulations

Anti-money laundering (AML) regulations are designed to prevent criminals from using gambling companies to launder money. Gambling companies are required to comply with AML regulations to prevent money laundering activities. Understanding AML regulations is essential for gambling companies to ensure compliance and protect their business and customers.

The compliance requirements for gambling companies involve identifying and verifying customers, conducting ongoing monitoring of transactions and suspicious activities, and conducting due diligence on high-risk customers.

Additionally, gambling companies must implement robust AML policies and procedures, including training and education for employees, conducting regular audits and reviews, and maintaining effective AML controls and monitoring systems.

Failure to comply with AML regulations can result in severe consequences for gambling companies, including financial penalties, reputation damage, and legal action. Therefore, it is essential for gambling companies to understand and adhere to AML regulations to ensure compliance and protect their business.

Overall, AML compliance is critical for gambling companies to combat money laundering activities and provide a secure gaming environment for customers.

Building an Effective AML Program for Online Casinos

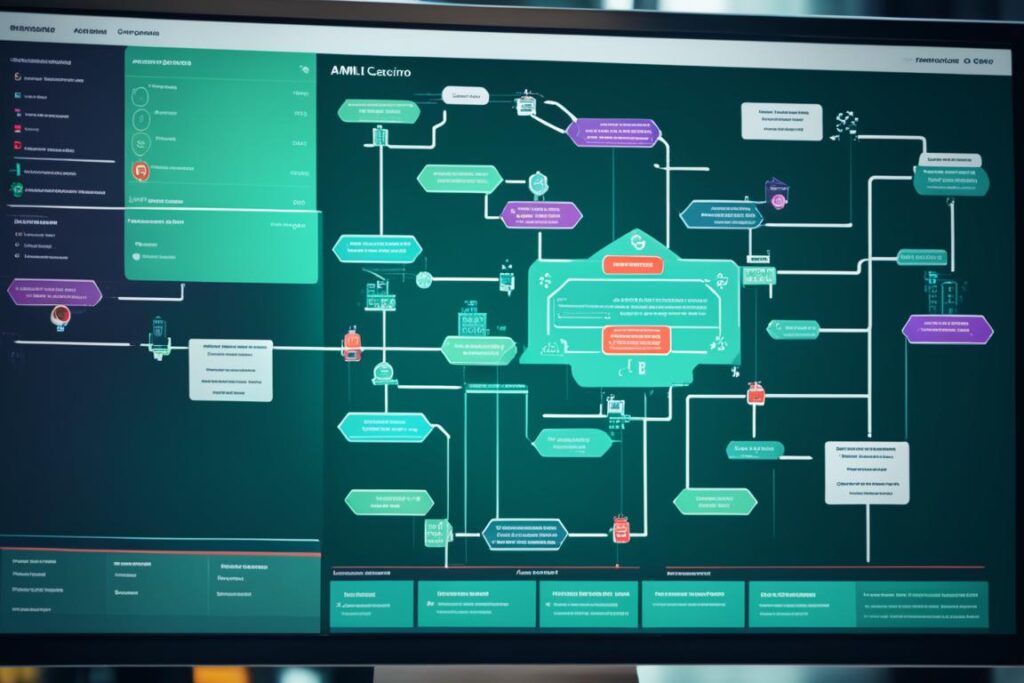

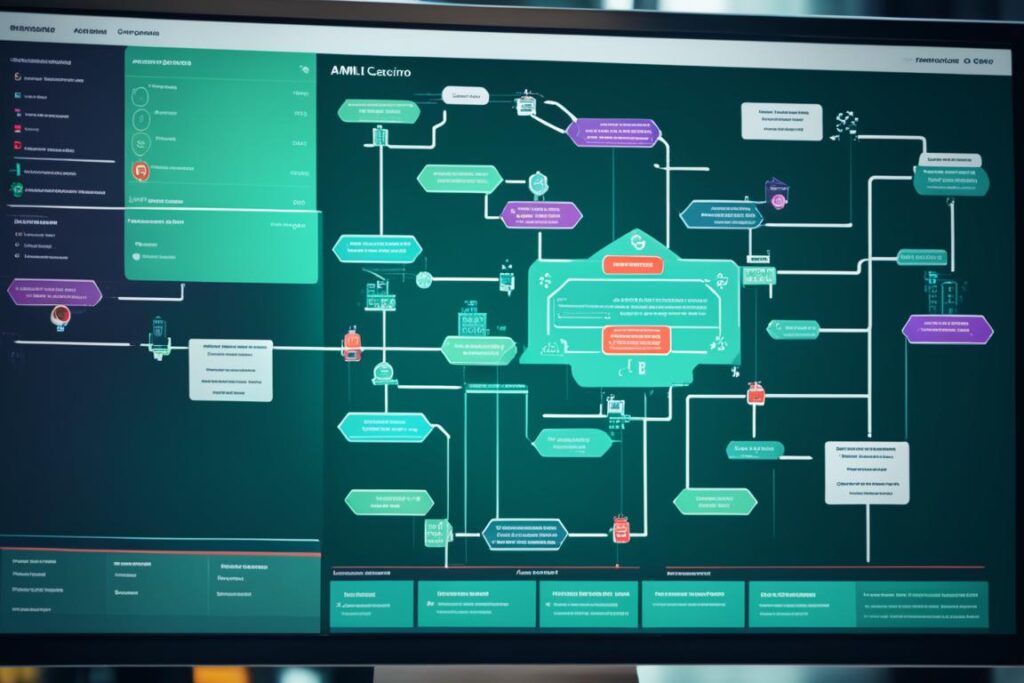

As online casinos become increasingly popular, it is essential for gambling operators to implement a robust Anti-Money Laundering (AML) program that is specifically tailored to their needs. A well-designed AML program comprises of many components that work together to prevent money laundering activities.

One of the significant components of an effective AML program is software that can streamline compliance efforts. Numerous AML software options are tailor-made for gambling operators. Such software can help in identifying high-risk players, provide real-time fraud detection alerts, and minimize compliance errors.

However, using AML software alone is ineffective without the proper infrastructure in place. Therefore, developing effective policies and procedures alongside utilizing these software solutions can lead to a more comprehensive compliance program.

As part of your comprehensive AML program, consider educating your staff to detect any potential money laundering activity on your platform. Training your employees to recognize suspicious behavior and report it to the appropriate authority goes a long way towards complete AML compliance.

In conclusion, having a robust AML program that includes software solutions and proper infrastructure can go a long way in preventing money laundering. By implementing these solutions and training your staff, gambling operators can minimize their risk of non-compliance and ensure a safer gaming environment for customers.

Conducting Risk Assessments for the Gambling Industry

Conducting comprehensive risk assessments is a crucial step towards achieving Anti-Money Laundering (AML) compliance for gaming operators. A proper risk assessment program must identify and assess the risk of money laundering in all aspects of a gambling business, including types of wagering, customers, and geographical locations.

Risk assessments should be conducted regularly, with a focus on identifying and mitigating high-risk areas. By identifying vulnerabilities in their AML systems, gambling businesses can implement measures to minimize money laundering activities and ensure that their compliance program stays up-to-date with the latest regulatory requirements.

“Risk assessments serve as the foundation for a robust and effective AML compliance program for gambling operators.”

To conduct a successful risk assessment, gaming operators must have a clear understanding of the money laundering risks associated with their sector. There are various risk assessment tools available in the market to assist with this process, and gaming operators should take advantage of these tools to ensure that their compliance program is tailored to their specific needs.

Overall, the ability to conduct effective risk assessments is a critical aspect of AML compliance for gaming operators. By identifying and mitigating potential money laundering risks, gambling businesses can protect themselves from regulatory penalties, reputational damage, and other negative consequences.

Customer Due Diligence in Online Gambling

Ensuring compliance with anti-money laundering (AML) regulations is crucial for online gambling platforms. Conducting customer due diligence is an essential aspect of AML enforcement for betting companies. To achieve this, thorough customer identification and verification procedures must be in place.

The customer due diligence process involves gathering and verifying information about customers to establish their identity and assess the risk of money laundering. This includes obtaining customer identification data and performing risk assessments. Online gambling platforms must also conduct ongoing monitoring of customer activity to detect and report suspicious transactions.

Failure to comply with customer due diligence requirements can result in significant legal and reputational consequences for gambling companies. Not only can companies face regulatory penalties, but also potential loss of customers due to a lack of trust in the platform’s security measures.

For effective customer due diligence, online gambling platforms should also consider investing in AML software solutions to streamline the process and enhance compliance efforts. These tools can automate customer identification and provide real-time monitoring of transactions.

Implementing Robust AML Policies and Procedures

Developing and implementing effective anti-money laundering policies and procedures is crucial for gambling companies to ensure compliance with regulatory requirements and prevent money laundering activities. Robust AML policies and procedures are especially important for the gambling industry due to the high risk of money laundering associated with cash-intensive transactions and the potential for large sums of money to be moved rapidly across borders.

When implementing AML policies and procedures, it is essential to take into account the unique needs of the gambling industry. This includes prioritizing risk assessments, conducting customer due diligence, and implementing effective AML controls and monitoring systems.

To ensure that your AML policies and procedures are effective and tailored to your business needs, consider the following best practices:

- Assess and identify AML risks specific to your organization: Conduct risk assessments to identify and manage the inherent risks associated with your business. Prioritize the risk areas that pose the greatest risk to your organization.

- Develop and implement a comprehensive AML program: Establish detailed policies and procedures to prevent, detect, and report money laundering activities. Ensure that all employees receive training and understand the significance of AML compliance.

- Conduct ongoing monitoring and reviews: Continually assess the effectiveness of your AML program and make changes to improve its performance.

- Collaborate with regulatory authorities: Maintain open communication with regulators and promptly report any suspicious activities or transactions.

By implementing these best practices, gambling companies can develop AML policies and procedures that are tailored to their unique needs and mitigate the risks associated with money laundering activities. This ensures that the gambling industry is compliant with regulatory requirements and provides a safe and secure gaming environment for customers.

Training and Education for AML Compliance

Being compliant with anti-money laundering regulations is a top priority for gambling companies. AML compliance helps to prevent illegal financial activities in the gambling industry, ensuring a fair and secure gaming environment for customers. One of the key components of a successful AML compliance program is providing proper training and education for employees.

Training should cover all aspects of AML compliance, including identifying and detecting suspicious transactions, record-keeping practices, and reporting obligations. It is essential that employees are aware of the relevant compliance requirements for gambling companies and understand how to spot potential money laundering activities.

Regular training will help to reinforce AML best practices and ensure that employees are up-to-date with any changes to AML regulations. In addition, providing ongoing training and education demonstrates a commitment to AML compliance and helps to foster a culture of compliance within the organization.

By investing in employee training and education, gambling companies can better protect their business from money laundering risks while promoting a safer gaming environment for their customers.

Key takeaways:

- Training and education are crucial components of a successful AML compliance program in gambling companies.

- Employees should be trained on the relevant AML regulations and how to identify potential money laundering activities.

- Regular training helps to reinforce AML best practices and foster a culture of compliance.

Conducting Effective AML Audits and Reviews

Regular AML audits and reviews are crucial for ensuring ongoing compliance with the relevant laws and regulations. By conducting thorough audits, gambling companies can identify areas that require improvement and take corrective action to mitigate risks associated with money laundering activities.

During an AML audit, focus on the key areas where money laundering is most likely to occur. These include:

- Customer due diligence processes

- Transaction monitoring systems

- Record-keeping procedures

- Employee training and education programs

- Business relationships with third-party providers and vendors

Reviewing each of these areas in detail will help ensure that your AML program is complete and effective. Additionally, focus on testing the internal controls that are in place to prevent money laundering, and make sure that your staff understands their AML responsibilities and the company’s policies and procedures.

When issues are identified during an audit or review, it is essential to take corrective action promptly. This includes implementing changes to policies and procedures, improving employee training and education programs, and enhancing AML software tools where necessary.

By regularly conducting AML audits and reviews, gambling companies can maintain and continuously improve their AML compliance programs, reducing the risks associated with money laundering and ensuring a safer environment for their customers.

Maintaining Effective AML Controls and Monitoring

Effective AML controls and monitoring systems are essential for gambling companies to prevent money laundering. Compliance requirements for gambling companies necessitate that they implement robust monitoring systems that can detect any suspicious activities.

To maintain effective AML controls, gambling companies should regularly review their internal policies and controls. They should ensure that their employees have been trained appropriately on AML regulations and that they understand the importance of complying with them.

Gambling companies should also implement automated AML software that can monitor transactions in real-time and flag any suspicious activities. Such software can help to detect and mitigate risks associated with money laundering.

By maintaining effective AML controls and monitoring systems, gambling companies can reduce the risk of money laundering activities, protecting their reputation and customers.

Collaboration with Regulatory Authorities and Reporting Obligations

Collaborating with regulatory authorities and fulfilling reporting obligations is crucial for gambling companies to ensure AML compliance. This involves establishing effective communication channels with regulatory bodies and promptly reporting any suspicious activities or transactions.

AML enforcement for betting companies is a top priority for regulatory authorities, and failure to comply with regulations can result in severe consequences, including hefty fines and reputational damage.

By collaborating with regulatory authorities and fulfilling reporting obligations, gambling companies can demonstrate their commitment to AML compliance and prevent potential risks associated with money laundering activities.

Conclusion

AML compliance is crucial for gambling companies to prevent money laundering activities and secure a safe environment for their customers. By understanding anti-money laundering regulations and building an effective AML program, gambling companies can meet compliance requirements and mitigate associated risks.

Implementing robust AML policies and procedures, conducting regular training and education for employees, and maintaining effective monitoring and controls can contribute to ongoing compliance efforts. Collaboration with regulatory authorities and fulfilling reporting obligations is also essential to demonstrate compliance with AML regulations.

Gambling companies must prioritize AML compliance to safeguard their business and maintain the trust of their customers. By taking proactive measures and implementing best practices, companies can prevent money laundering activities and ensure a secure gaming environment for all.

FAQ

What are the main anti-money laundering (AML) regulations that apply to gambling companies?

Gambling companies are subject to various AML regulations, including the Financial Action Task Force (FATF) recommendations, local AML laws and regulations, and industry-specific requirements. These regulations aim to prevent money laundering and terrorist financing activities within the gambling industry.

What compliance requirements do gambling companies need to adhere to?

Gambling companies must implement robust AML programs, conduct risk assessments, perform customer due diligence, maintain effective AML controls and monitoring systems, collaborate with regulatory authorities, and fulfill reporting obligations. These requirements ensure that gambling companies comply with AML regulations and prevent money laundering activities.

How should risk assessments be conducted in the gambling industry?

Risk assessments in the gambling industry should involve identifying and evaluating the risks associated with money laundering. This includes assessing customer profiles, payment methods, geographic locations, and high-risk activities. By conducting thorough risk assessments, gambling companies can develop targeted mitigation strategies to prevent money laundering.

What is customer due diligence in online gambling?

Customer due diligence refers to the process of verifying the identity of customers in online gambling platforms. This involves collecting and analyzing customer information, conducting risk assessments, and implementing ongoing monitoring. Customer due diligence is crucial for identifying and preventing money laundering activities within the online gambling sector.

How can gambling companies implement robust AML policies and procedures?

To implement robust AML policies and procedures, gambling companies should develop tailored compliance programs that address the specific risks and requirements of the industry. This includes establishing internal controls, conducting regular training and education, and staying updated on AML regulations and best practices.

Why is training and education important for AML compliance in gambling companies?

Training and education play a crucial role in achieving AML compliance within gambling companies. By educating employees on AML regulations, money laundering typologies, and red flag indicators, gambling companies can empower their staff to recognize suspicious activities and report them appropriately. Ongoing training ensures that employees stay informed and vigilant against money laundering risks.

How should AML audits and reviews be conducted in gambling companies?

AML audits and reviews in gambling companies should be conducted regularly to assess the effectiveness of compliance efforts. These audits should cover areas such as AML policies and procedures, customer due diligence, transaction monitoring, reporting mechanisms, and training programs. Any identified issues should be addressed promptly to ensure ongoing compliance.

Why is maintaining effective AML controls and monitoring important for gambling companies?

Maintaining effective AML controls and monitoring systems is essential for gambling companies to detect and prevent money laundering activities. Robust controls should be in place to verify customer identities, monitor transactions for suspicious patterns, and report any suspicious activities to regulatory authorities. Regular monitoring ensures that any potential risks are identified and addressed promptly.

How should gambling companies collaborate with regulatory authorities and fulfill reporting obligations?

Gambling companies should establish a collaborative relationship with regulatory authorities by staying updated on AML regulations, maintaining open lines of communication, and cooperating in investigations. They should also fulfill their reporting obligations by submitting timely and accurate reports of suspicious activities as required by local AML laws and regulations.

What is the importance of AML compliance in the gambling industry?

AML compliance is crucial in the gambling industry as it helps prevent money laundering, safeguard the integrity of the industry, and protect customers from financial crimes. By implementing effective AML strategies and complying with regulations, gambling companies can maintain a secure gaming environment and enhance their reputation.